Invoice mandatory information

Every entrepreneur has to issue invoices when selling their services or products. But what information must be found on an invoice and what information is voluntary?

In this article we clarify which mandatory information must not be missing on an invoice and what you have to pay attention to as a small business owner who is exempt from sales tax. With the following tips, you will be able to write legally compliant invoices quickly and easily.

Before you write the bill

An invoice contains services that are billed to a customer. The invoice can be sent by post or as an electronic message, e.g. be done by email. Automatic e-mail dispatch is integrated as a function in Billtano.

But before you issue an invoice, you should consider the following points:

- Service period – invoices to companies must be written within 6 months after the service has been provided (private invoices are not bound by any deadlines)

- Retention period – Invoices must be retained for 10 years

- Invoices do not require a signature

- Small business regulation according to § 19 UStG – If you are a small business owner and make use of the small business regulation, you are not allowed to report sales tax. Simply note the clause on your invoice, e.g. in the footer. “According to § 19 UStG, the amount does not include sales tax.”

- Writing receipts – An invoice under €150.00 can be issued as a small amount invoice (colloquially known as a receipt) and has fewer mandatory details than an invoice

- Use templates – With cheap online billing software, you can make billing much easier. The required mandatory information is automatically integrated into the program and can also be customized.

Mandatory information on invoices

The most important thing for us is to spend as little time as possible writing the invoice.

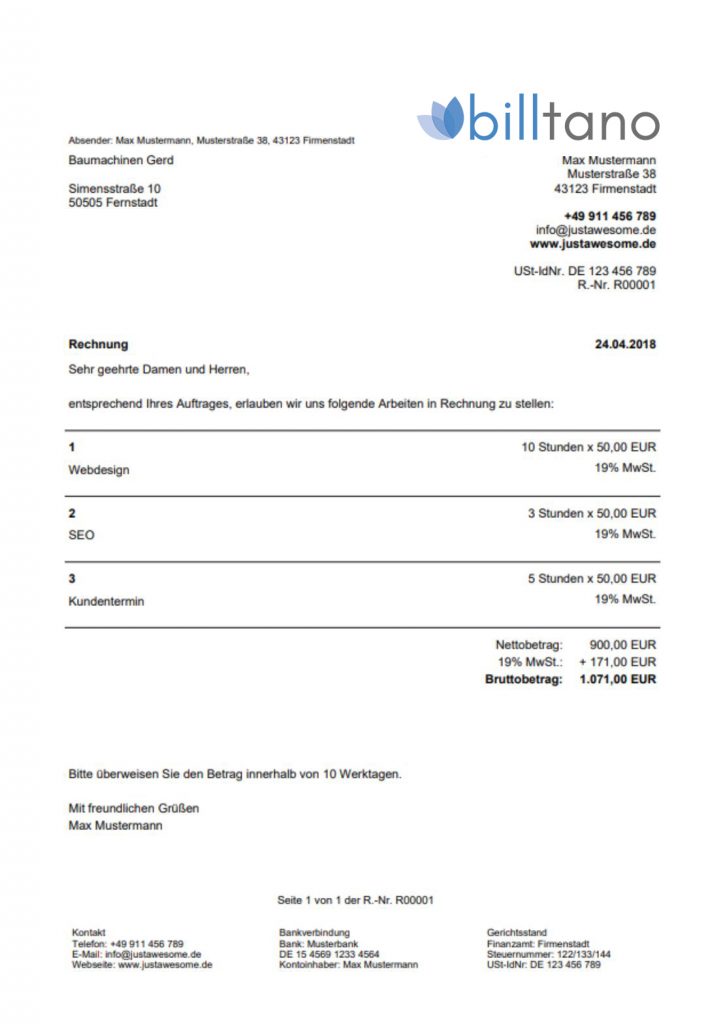

An invoice must contain the following information in order to be issued correctly:

- Full address of both parties – i.e. the service provider and the service recipient.

- Tax number – this is assigned to every trader bythe Federal Tax Agency.

- Sales tax identification number– short VAT ID number. must be on invoices to other European countries.

- Invoice Date – the time the invoice was issued.

- Service and quantity– it must of course be clear from the invoice which service or which product was purchased.

- Service period – in which the service was created.

- Invoice Amount – The amount to be paid.

- Tax amount– the tax amount included in the invoice amount and the tax rate must also be visible on the invoice.

- Notes on tax exemption – If the service is provided as a so-called intra-community serviceor as a small business with an exemption from sales tax, corresponding information must be found on the invoice: “According to § 19 UStG the invoice amount does not include sales tax.” or “According to § 6a UStG is the intra-community service tax-free.”

- Rebates & cash discounts – if rebates or cash discounts are agreed in the invoice, these must also be shown. For example, simply create a separate item in the table for the services described on the invoice.

- Bank details – Enter your bank details including bank name, account holder, IBANand BICso that the recipient can pay the invoice amount.

- Invoice number consecutively – The invoices are numbered, whereby the numbers must be kept consecutively without gaps. Durch die Nutzung eines Rechnungsprogrammes beugt man Zahlendreher vor.

Optional information, such as separate agreements on the payment term (a payment term of 30 days applies by law) can of course also be added to your invoice. You canalso define a place of jurisdiction.

Now you can send the invoice without hesitation. Are you a craftsman or service provider for existing customers? If you want to write recurring invoices, read on here.

At Billtano, writing invoices is uncomplicated and cheap. Time saves money – our prepaid offers save you valuable nerves and working time.